- 24 September 2016

RBA - Redundant Bank of Australia?

Up until now our predictions have been far better than those of the Reserve Bank. I am now convinced it is a Redundant Bank of Australia, a failed experiment of the Howard Government.

In my opinion the RBA should be merged back into Treasury and become the responsibility of our elected politicians who would have to become accountable by answering searching questions in English, not via the financial gobbledygook that we associate with the RBA’s monthly "statements".

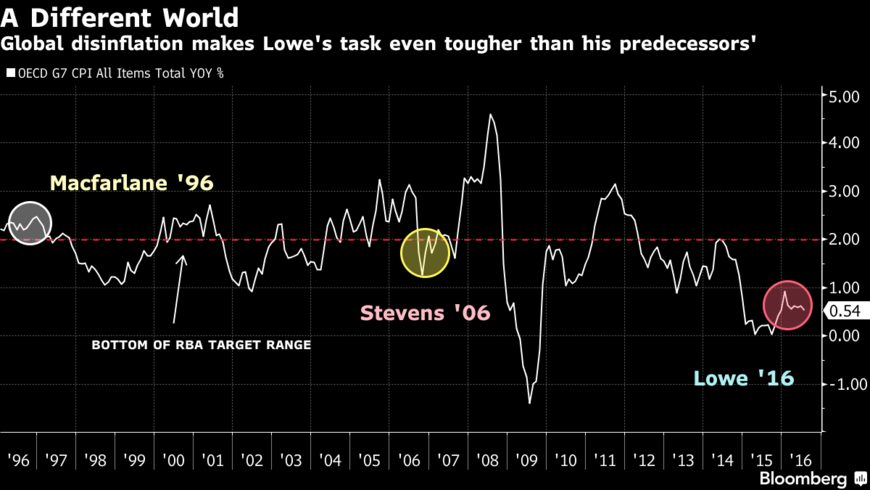

The chart below is exciting in that it shows the focus of the RBA has been on "containing inflation". It proves the RBA, egged on by successive Prime Ministers, has been fighting the wrong battle! High inflation was a problem - was!

But in the last two decades, overseas low rates passed the common-sense test in delivering low inflation. Meanwhile, in Australia, Ian McFarlane, followed by Glenn Stevens, marched us into a high-rate regime, arguing illogically that these would bring down inflation!

But what now?

Surely this is an opportunity for our new RBA Governor, Philip Lowe. Surely it is and opportunity for Turnbull and Morrison. Let's discard inflation as the goal of the RBA and focus on its number one priority which is full employment. Yes, that's right! This is the RBA's opportunity to do its job, fulfil its mandate and look after us.

How?

How they can help us is to put money back into the pockets of consumers and away from the big four banks.

- Morrison and the RBA should call the bank executives and demand that they pass on all the rate cuts in full - as previous governments up until Rudd always did.

- The Government should use the upcoming October "interrogation" of the banks to ask the really hard questions. Rudd gave them a monopoly which they have abused. Ask them how they would establish competition into the banking sector now that they have gobbled up most of the smaller banks. Attendees at our workshops are surprised to find, for instance, that Aussie Home Loans is not competition at all, but actually fully owned by the Commonwealth Bank.

- Turnbull and Morrison should reverse the blundering, ill-conceived and poorly-researched attack on property investors by APRA and RBA. It is only increasing supply from these people that will contain price rises. Basic Economics 101!

- I attended a finance summit last Friday. All agreed that the main danger facing Australia was our dependence on overseas funds for our banking sector. Again, the solution is easy for Turnbull and Morrison. You hate Super. All those not in a Self-Managed Super Fund know it is a waste of your money and will only support you for the first five years of your retirement after a lifetime of this tax on your labour. This is Keating's curse on the economy. So let’s change it from a waste of your money to a solution of our overseas financial crisis. Simply allow our workers to use their money to reduce their mortgage or investment loans.

How does this work? The first benefit to you is that there are no sticky fingers taking fees and charges out of your money. The second benefit is that your investment is mostly in safe bricks and mortar, or it is being used for other investments of your choice for your long term benefit. These investments will quarantine you against market volatility for your retirement. As you reduce your bank loans so our banks will need to borrow less and less from overseas. Australia becomes less dependent on overseas funds and is less affected by overseas financial shocks.

What are the hurdles to this very logical use of your money? The union masters who are collecting the world's highest fees and charges, as are the banks who have gobbled up the financial planning businesses that are also sucking on your "labour tax". So Turnbull and Morrison won't have the guts to take on these huge enemies? Well, what about the Senate?

The Senate could first start by proposing these changes along with an immediate plan to allow the workers to take home their 9.5% "labour tax". The "rivers of gold" will stop running into the Super Funds which have no capacity to sensibly invest your contributions, which instead would pour into consumers’ pockets. Consumers know how to spend wisely to create real jobs in the economy.

So what does all of this mean for property investors?

For the first time in two decades there is an opportunity to have our captains of the economy help the workers in the economy and that has to be good for you and me. So there is the challenge for Lowe (RBA), Wayne Byers (APRA), Turnbull (Prime Minister), Morrison (Treasurer).

Who will take up the challenge and rise to help the workers? Who will fail the common-sense test? Happy investing, Kevin Young

Related Posts

Why the February RBA Decision Matters More Than the Headline

With the Reserve Bank of Australia heading into its February interest rate meeting, borrower attention is back on rates, repayments and loan structures. Recent economic data has shifted expectations, and uncertainty is now the dominant theme. Inflation has proven slower to cool than anticipated, and that has placed...

What World Data Privacy Day Means for Property Buyers

Each year on January 28, World Data Privacy Day serves as a global reminder of the importance of protecting personal information in an increasingly digital world. While data privacy is often associated with passwords, apps and online security, it is just as critical when it comes to property transactions. Buying or...

From February 2026, Borrowing Gets Harder. Plan Before It Does.

From 1 February 2026 , new lending rules will change how Australian banks assess higher borrowing levels. For many buyers and investors, the outcome will not hinge on the property they choose. It will hinge on access to finance. If buying, investing or refinancing is part of your plans in 2026, this change matters....