Property Tip #11

Have trusted advisers/service providers interstate so you can buy away from home with confidence.

Have trusted advisers/service providers interstate so you can buy away from home with confidence.

New Canstar research shows that many Australians are quietly reassessing their housing situation. According to the survey, more than one in four homeowners are considering their next move over the coming year. The figures vary across the states, with Queensland showing the highest proportion of people thinking about...

Every year the property market slows as people turn their attention to travel Christmas shopping and family time. With so much noise around the holidays it is easy for investors to absorb advice that sounds reasonable but has little basis in how the market actually works. Property Club continues to watch these...

Sydney is heading into another shift, but it is not happening in the prestige house market or the headline grabbing suburbs. The real movement is in well-located units sitting close to transport, education and major employment hubs. These are the properties renters line up for and the ones buyers turn to when house...

Most investors think they choose a suburb based on research, data and logic. In reality there is often something deeper at play. Suburbs hold emotional weight. They remind us of where we grew up, where our friends live, where we once rented, or where we felt safe. Familiarity feels comfortable, which is why so many...

The Sunshine Coast and Gold Coast have long been known for surf and holidays. But right now, both are being redrawn not by the tide but by transport lines. The next decade of growth in Queensland will be built along the tracks. The Sunshine Coast Rail project and the Gold Coast light rail expansion are reshaping what...

Queensland’s housing market has an imbalance that is quietly reshaping demand. Across South East Queensland, 62 per cent of households are one or two people, yet 72 per cent of homes have three or four bedrooms. It’s a clear mismatch between how people live and what we’re building. The new household reality is...

WA’s lifestyle pull is powering the next wave of smart investment. Western Australia is back in the spotlight and this time it is not just resources driving the boom. The state has become Australia’s lifestyle magnet, drawing new residents from across the country and around the world in record numbers. According to...

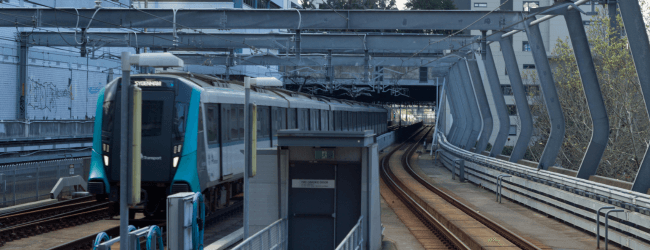

In Sydney, convenience is currency. Nowhere is that more evident than around the city’s new Metro North West line. Buyers who moved early, often during the dust and disruption of construction, are now sitting on gains of up to 39 per cent compared to similar homes just a few streets further away. Domain’s new data...

Western Australia has once again taken the crown as the nation’s strongest economy, leading the CommSec State of the States rankings for the fifth consecutive quarter. The West continues to outperform every other state and territory, driven by strong household spending, high housing finance activity, and record...

The 2025 Oxford Economics Global Cities Index ranked Melbourne 6th globally, ahead of cities such as Tokyo and San Francisco. This recognition is not just prestige. It is a measure of global competitiveness that carries real implications for investors. What the Ranking Captures The Global Cities Index assesses 1,000...

For years, the talk has been that Sydney is too expensive, that the best time to buy has passed, and that the market will cool. Yet history shows Sydney never stays quiet for long. After the Reserve Bank’s first interest rate cut earlier this year, buyer activity lifted and clearance rates rose above 70 per cent...

Brisbane is no longer the quiet achiever of Australia’s property market. It has emerged as the nation’s fastest growing capital city, outpacing Sydney, Melbourne and Perth on key economic and demographic fronts. For property investors, this is more than a local story, it is a global one. A Population Boom with...

Our mission is to help the average Australian learn the property market dynamics and discover the amazing opportunities that exist in real estate.